Preservation Solutions

Taxes & Tax Planning

Orange County Tax Attorney & Certified Public Accountant

THE BIG 3 TAXES

Property taxes, income and capital gains taxes, and estate taxes are potentially very large in the estate planning, trusts and probate area. If a transfer of property or money is made without predicting these taxes you might not like the results.

For example, sometimes elderly couples transfer legal ownership of their house to their children since they figure the children are going to get it anyway when they pass on. Doing this type of transfer can cause the children to have large capital gains income taxes to pay when they eventually sell the house. Suppose that the parents paid $100,000 for the house and when they transfer it is worth $600,000. Under the income tax laws, the children who received the gift of the house take over the parents tax basis which is $100,000. If the children then sell it for $600,000 they will have a $500,000 reportable capital gains which would roughly amount to hundred and $166,650 federal and state income tax. Also, if the children don’t do the right paperwork with the County assessor, the property taxes could drastically increase.

A far better plan is for the parents to retain ownership of the house until they pass away and let the children then inherit at the house. If property is inherited than the tax basis is increased to the date of death value which in the above example would be $600,000. The children could then sell the house for $600,000 and have no capital gains tax whereas if they would receive the house prior to the parents’ death the taxes would have been $166,650 approximately.

On the other hand, if the parents have a very large estate which is subject to federal estate tax of approximately 40%, the family may actually save estate taxes by gifting the house to the children prior to death.

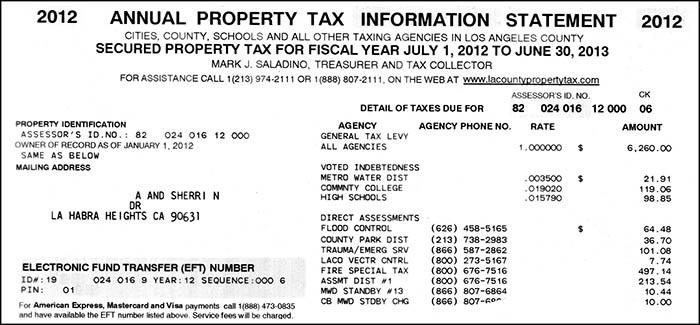

PROPERTY TAXES

The various counties in California have various forms they use to determine if the property taxes should or should not go up on a particular transfer. At Crockett law Corporation, we typically assist clients on all phases of property transfers and on using the correct forms to try to keep the property taxes from increasing. We typically try to structure transactions that prevent property taxes from increasing. The exemptions from property taxes increases on a transfer are very technical and in some instances depend upon giving the county a proper explanation and/or having a proper trust document in use that will be acceptable to the County.

ESTATE TAXES

Our client-tailored estate plans are designed to minimize estate taxes. Many estates these days are below the federal estate tax exemption which is currently $5 million per person plus a cost-of-living increase each year. However, federal estate taxes have historically had much lower exemptions and there is no guarantee that the exemptions will stay high as they are now. Our documentation takes into account the possibility that the exemption may be lowered so planning and estate allocation of asset issues are dealt with.

INCOME TAXES

Income taxes are always a factor in people’s trusts and estates. There are often many choices as to how transactions are structured as far as income taxes are concerned. At Crockett law Corporation we can generally predict and compute in advance what the income tax effects will be on any property, stocks, bonds, or money held in any trusts or estates. If there is a closely held business we pay particular attention to the form of ownership and agreements among the various owners so as to minimize income taxes or legal problems if one of the owners dies. We have represented clients in some very unfortunate situations where closely held business owners did not plan for the eventual death of one of the owners and simply left to chance what would happen. This often leads to expensive and prolonged litigation which usually could have been prevented by proper documentation and agreements being put in place.

Income taxes are always a concern in tax-deferred exchanges, tax deductions being taken, form of ownership issues and virtually any purchase, sale, or gift. For example, there are different types of corporations for income tax purposes. Unless the proper forms are filed with the Internal Revenue Service within strict time deadlines, the income tax treatment of the Corporation may not be what the owners actually would prefer. All of these types of issues are readily discussed by Crockett law Corporation with its clients and courses of action are determined in advance so that the tax consequences are understood in advance.

PERSONNEL SKILLED IN TAX ADVICE

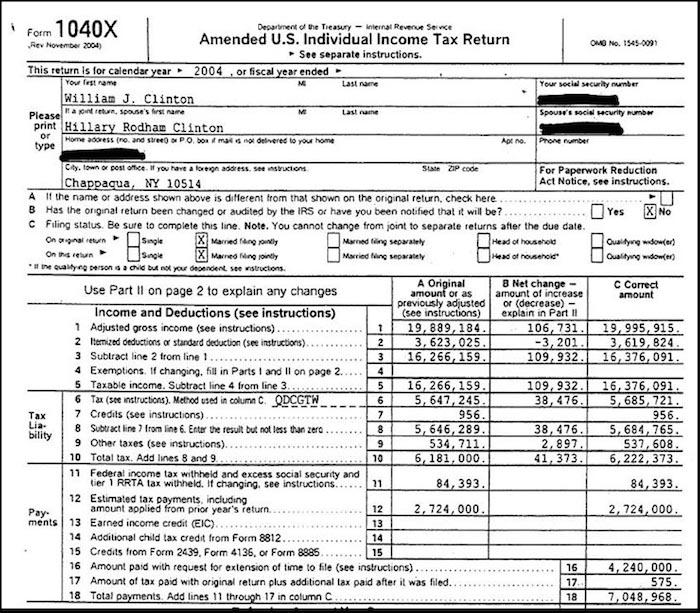

At Crockett Law Corporation, founder David Crockett who is licensed both as an attorney and certified public accountant can compute and predict the taxes in any type of estate planning transfer or probate situation. He is familiar with all of the tax forms and has them all on his computer system as he actually does prepare income tax returns and federal estate tax returns on a regular basis. Thus, in a typical consultation session, the actual forms that would be involved in tax reporting of any transaction can be pulled up on the computer screen and explained to the clients.

Read David Crockett’s Detailed Blog Posts:

Click Here for Posts Regarding TAXES